Well That's Mildly Embarrassing ...

/Surveys show that 75% of people have trouble with percentages. The remaining 50% find them no trouble at all. Turns out I'm part of the 75%.

A few weeks back I detected what I thought was an error in the way I was calculating the contribution of the return from the Margin Fund to the price of the Recommended Portfolio. I said then that:

(Note that the Portfolio price shown for the past two weeks has been slightly in error as I'd been adding the ROIs for the two SuperMargin Predictors, Combo_NN2 and Bookie_9, rather than averaging them. Practically, that means our loss in Round 1 and our profit in Round 2 were both smaller than I reported.)

Well, I was wrong - in that I was right to begin with - a fact I discovered when I performed the first routine reconciliation of the season's wagering last night. It's not often you discover that a bookmaker has more of your money that you'd realised. I'll spare readers the specifics, but the effect of my error is that I've been understating the contribution of the Margin Fund by 50%, which is good news when you realise that this Fund is up by over 42% this season (and not 21%, as I'd previously reported).

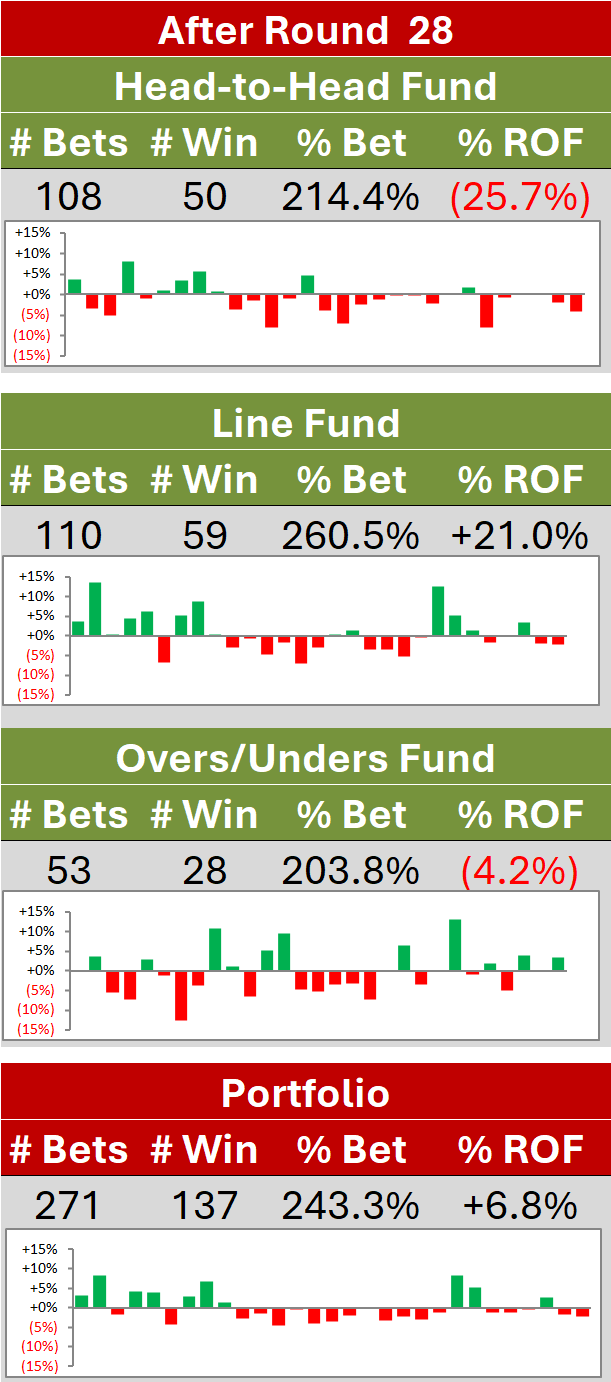

That understatement, in turn, means that the Recommended Portfolio is actually only down by a little over 1c and not 3c. The restated results for each round are as follows, where figures in brackets are losses:

- Round 1: Head-to-Head Fund (5.5%); Line Fund (2.8%); Margin Fund (5.0%); Recommended Portfolio (3.8%)

- Round 2: Head-to-Head Fund (1.0%); Line Fund +1.0%; Margin Fund +15.0%; Recommended Portfolio +1.8%

- Round 3: Head-to-Head Fund +0.7%; Line Fund +0.9%; Margin Fund +11.3%; Recommended Portfolio +1.8%

- Round 4: Head-to-Head Fund (0.7%); Line Fund +1.0%; Margin Fund +3.1%; Recommended Portfolio +0.7%

- Round 5: Head-to-Head Fund (0.4%); Line Fund (1.5%); Margin Fund (0.6%); Recommended Portfolio (1.1%)

- Round 6: Head-to-Head Fund (1.6%); Line Fund (3.3%); Margin Fund +18.8%; Recommended Portfolio (0.6%)

- Cumulative After 6 rounds: Head-to-Head Fund (8.5%); Line Fund (4.6%); Margin Fund +42.5%; Recommended Portfolio (1.1%)

That's all good news then - in a "more money = good, less money = bad" kind of way, if perhaps less so in an "oh my god, this guy's making wagers using allegedly sophisticated statistical models incorporating the finest machine-learning algorithms that the world has to offer, and he apparently can't add" kind of way. I'll leave it as an exercise for each reader to determine where he or she nets out on that one.

(Long-term MAFL Investors shouldn't be too startled, I'd assert, by this latest mea culpa. It's not as if I don't have form for making wagers and mathematical errors in relation to MAFL. See, for example, the Special Stupidity Dividend of 2006, details of which appear in Newsletter #19.1 from that year, which you can download via the "MAFL - The Early Years" link in the navigation bar.)

Anyway, being nothing if not consistent, my erroneous thinking has flowed directly into my Ready Reckoners each week, so they too have understated the potential gains and losses from Margin Fund wagers. That has also now been rectified.

Thank heavens no one pays me for all this mathsy stuff. Oh, wait a minute ...