2015 - Round 27 Results: Hawks, Easily

/Hawthorn were Rated the Number 1 team by MARS at the start of the season and at the end of every round, and by ChiPS at the start of the season and end of every round too except Round 2 when the Swans briefly snatched that honour. So, it seems fitting that the Hawks took out the 2015 AFL Grand Final in convincing style.

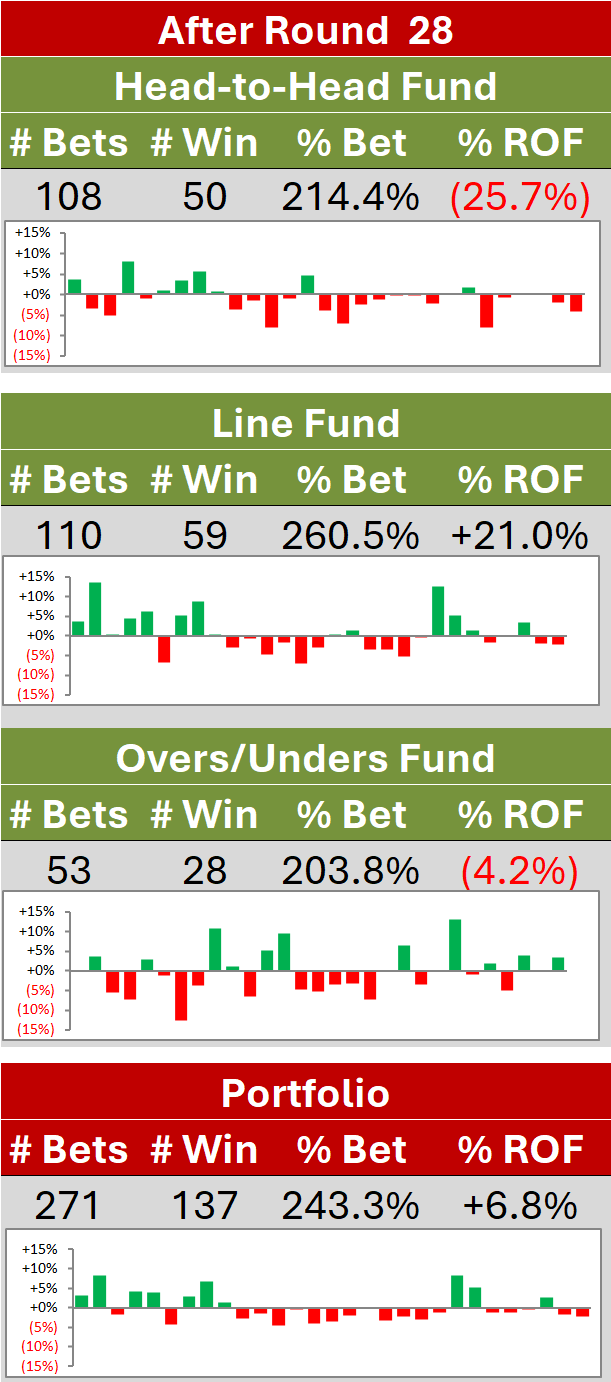

Investors had no stake in the result, their ultimately unprofitable season having been a foregone conclusion for many weeks now. For the record, the Head-to-Head Fund finished the season having turned the original stake 1.3 times with a 23 and 41 win/loss record, a -35% ROI, and a -45% RONF.

A review of the performance on a team-by-team basis reveals that Sydney, Collingwood and GWS cost Investors most when wagered on head-to-head, these three teams alone responsible for about 30c of the 45c loss. Only five teams returned a profit head-to-head for Investors: the Western Bulldogs, West Coast, Fremantle, Geelong and the Kangaroos.

The Line Fund fared only a little better, turning the original stake about 1.6 times and finishing with a 26 and 40 win/loss record, a -20% ROI, and a -31% RONF. Its losses were concentrated in two teams, the Dons and Lions, who together accounted for almost 24c of the 31c loss. Seven teams provided Investors with a positive return when wagered on in the line market: the Western Bulldogs, Kangaroos, West Coast, Geelong, Melbourne, Collingwood and Fremantle.

Combined, losses were made on 13 teams, the largest on Essendon (9.9c), Sydney (7.9c), Brisbane Lions (7.7c), and GWS (6.4c). Together, those four teams accounted for almost 90% of the overall loss, and the Lions and Dons represented 16 wagers without a return. Five teams made an overall positive contribution to Investors: the Western Bulldogs, West Coast, Kangaroos, Geelong and Fremantle.

Reviewing the season's wagering from another perspective - from the viewpoint of the team wagered against - we find that, head-to-head, two teams account for over half the loss: Hawthorn and Geelong. Wagering against them cost the Head-to-Head Fund over 28c. Six teams were profitably wagered against head-to-head across the season, though only Collingwood (5.1c), GWS (4.8c), Gold Coast (2.4c), and Essendon (1.8c) made any significant contributions via their losses.

For the Line Fund, wagering against Adelaide, Geelong, the Kangaroos, Sydney and Carlton proved most costly, those five teams representing more than the entirety of the loss. Seven teams provided a profit when wagered against in the line market, most lucratively Hawthorn (4.9c), the Western Bulldogs (4.4c) and Essendon (3.3c).

Combined then, wagering against Geelong, Adelaide, the Kangaroos, Sydney and West Coast proved most expensive, and wagering against GWS, the Western Bulldogs and Essendon the most lucrative.

No matter how you cut the data, the 2015 wagering season has been a poor one.

TIPS AND PREDICTIONS

From a tipping and predicting viewpoint, though, it's been an exceptionally good year.

C_Marg tops the Head-to-Head Tipsters with a 149 and 57 (72%) record, four tips clear of the field and also tops the Margin Predictors with a final Mean Absolute Error (MAE) of 29.8 points per game, below the magic 30 and almost three-quarters of a point better than the next-best Predictor, ENS_Greedy. C_Marg finished ahead of all Margin Predictors having assumed top position at the end of Round 16 and then never relinquishing it.

ENS_Greedy was the first of six ensemble predictors filling positions 2nd through 6th on the MoS Leaderboard this season, emphatically affirming the efficacy of models of this type in predicting AFL results. The significantly poorer performance of the two Predictors based on neural networks, Combo_NN1 and Combo_NN2, and of the H2H-, ProPred- and WinPred-based Predictors, suggests that these models are no longer suited to the task and need either to be abandoned or significantly recalibrated.

Despite its poor MAE result, Combo_NN2 nonetheless managed to finish as one of just four Predictors with a season-long positive line-betting record, the three Predictors joining it being C_Marg, Bookie_3 and H2H_Adj_7 (just). What Combo_NN2 and C_Marg have most in common is an ability to avoid being very wrong, very often, they both being six or more goals in error in only 27% of games. Bookie_LPSO, one of only six Predictors to finish with a worse-than-chance record, registered the worst line-betting success rate of all the Predictors, picking the correct team only 44% of the time.

Bookie-LPSO also finished last amongst the three Bookie-based Head-to-Head Probability Predictors and fourth overall, C_Prob completing the sweep for the ChiPS-based forecasters in finishing top in this field after another Best In Round performance. The relatively poor performances from the H2H models, ProPred and WinPred here too underscores the need for a comprehensive review of them.

The Line Fund algorithm's final, bold line market prediction proved accurate, which lifted its per game average log probability score just above -0.04, quite a bit worse than its -0.027 average last year, its -0.031 average in 2013, and its -0.027 average in 2012. Clearly, a substantial review of this model is also required.