The Life We Might Have Led

/Though I doubt many of you are mourning the loss of the Funds that operated last year, I know I was curious to see how they would have performed had I allowed them to run around for another season.

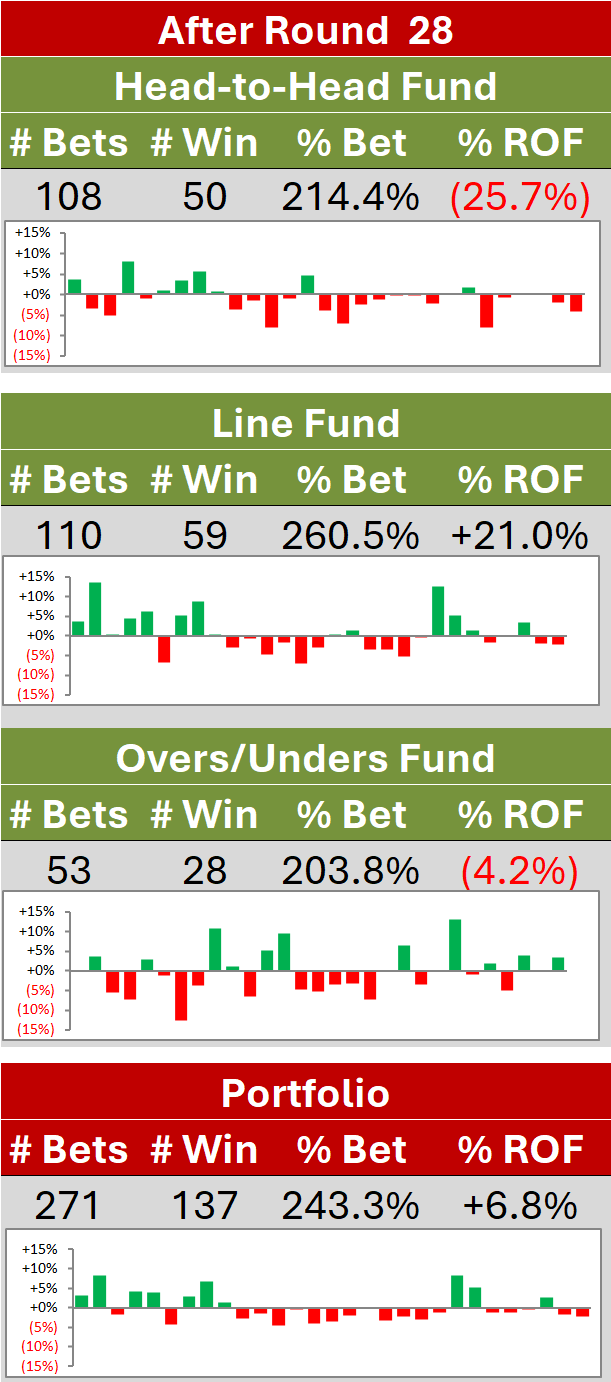

Let me start with a comparison of last year's Recommended Portfolio with this year's:

Starting with the obvious, Investors would have been happier at this point of the season - up by 22% rather than 10% - had last year's Funds and weightings been in force to create the Recommended Portfolio this year.

They'd not, however, have been in this state for all of the season, just for a period from the first game of Round 7, when Essendon beat Hawthorn and paid $5, to the first game of Round 11, and then again from the last game of Round 20, when Essendon toppled St Kilda and paid $6.50, to the present.

Interspersed with the periods of euphoria would have been long periods of despair as the Fund dropped to 80% of its value on two occasions before rebounding to its current levels. The fluctuations in the value of the 2008 Recommended Portfolio encompass a trough of almost -20% at the end of Round 8 to a peak of almost 30% at the end of Round 20. This range of about 50% contrasts starkly with that produced by this year's Recommended Portfolio, which is a range a touch less than half that amount and which includes a low point of only about -5%.

It'll be no surprise to anyone that the major cause of the dramatic fluctuations in the performance of the 2008 Recommended Portfolio would have been the Heritage Fund. In the chart below I've mapped its performance against that of the New Heritage Fund.

Pay close attention to the y-axis on this chart. The Heritage Fund peaks in value early in the season, climbing to +63% on the back of a lucrative wager on Freo at $3.75 who knocked off the Blues at Gold Coast Stadium, before plummeting to -69% at the end of Round 12 after a series of large and unsuccessful wagers, thereafter recovering, plummeting again and then climbing to a peak of +28% after the first game of Round 21, one game after landing the Dons at $6.50.

Also contributing to the superior performance of the 2008 Recommended Portfolio is the extraordinary success of last year's Line Fund compared to Line Redux.

The impressive result for the Line Fund has been achieved on the basis of just 29 wagers, 19 of them successful. Line Redux, by comparison, has eked out its profit on the back of 70 wagers with just 37 of them successful, a scant 2 wins better than chance.

Last year's Chi Fund has also performed better than this year's Chi-squared - well, more accurately, it's performed less worse. It has even, albeit briefly, drifted into profit.

Amongst the remaining Funds, Hope has outshone them all, though Alpha and Beta have also produced solid gains. Prudence has generated consistent if unspectacular profits.